Jimmy Johns gave me a blast from the past. I recently resigned from my job and for my last meal I wanted to visit a restaurant that I have been craving since I graduated college in 2004. When we arrived I felt like I was back at The Ohio State University in the early 2000s, making a choice between ramon noodles and a Jimmy Johns sub, while listening to an O.A.R. CD. However the reality was that I am 31 years old now, we car-pooled to Huntington (West Virginia) in order to save gas, and we could not stay long because someone had a meeting after lunch. Even with all of that boringness, Jimmy Johns delivered just like I dreamed it would and additional people were introduced to Jimmy Johns’ glory.

Why is Jimmy Johns Epic?

Jimmy Johns not only serves a great gourmet sandwich but I have always felt that the experience was what created this legend in my mind. The company philosophy of an honest, fast experience with a decent price is coupled with a delivery that is billed as “subs so fast that you’ll freak,” helps to make it a favorite on college campuses. I think that we can all learn from this in respect to the business development process of innovation, qualification and orchestration (The E-Myth Revisited) a great product that creates a customer experience that has in my experience built an eight year craving that has finally been met. If you talk to others that had a similar experience in college then they will express their loyalty to this restaurant. On the history section of their website I found this to be useful in explaining why I like them so much:

“Make a deal, keep a deal” is the Golden Rule. Do it now – make it happen – be a go-getter, no excuses. Jimmy Johns’ employees are the ordinary people doing extraordinary things. They want to be the best. They don’t mind doing whatever it takes to get the job done. Their hustle is part of how they live their daily lives, and they enjoy the fruits of a hard-earned entrepreneurial lifestyle. http://www.jimmyjohns.com

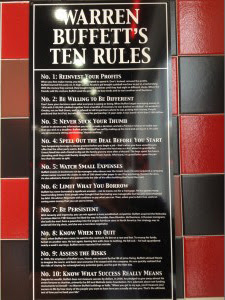

As an added bonus to the visit, my friend Josh pointed out one of the many signs that are placed throughout the store, which is very applicable to the small business wisdom subject matter. From searching the internet the regarding this sign, it seems that many have noticed and were influenced by the displaying of Warren Buffet’s Ten Rules for Success. I found them insightful and useful so here they are:

Warren Buffet’s Ten Rules for Success

- Reinvest Your Profits: When you first make money, you may be tempted to spend it. Don’t. Instead, reinvest the profits. Buffett learned this early on. In high school, he and a pal bought a pinball machine to put in a barbershop. With the money they earned, they bought more machines until they had eight in different shops. When the friends sold the venture, Buffett used the proceeds to buy stocks and to start another business.

- Be Willing to Be Different: Don’t base your decisions upon what everyone is saying or doing. When Buffett began managing money in 1956 with $100,000 cobbled together from a handful of investors, he was dubbed an oddball. He worked in Omaha, not on Wall Street, and he refused to tell his partners where he was putting their money. People predicted that he’d fall, but when he closed his partnership 14 years later, it was worth more than $100 million.

- Never Suck Your Thumb: Gather in advance any information you need to make a decision, and ask a friend or relative to make sure that you stick to a deadline. Buffett prides himself on swiftly making up his mind and acting on it. He calls any unnecessary sitting and thinking “thumb-sucking.”

- Spell Out the Deal Before You Start: Your bargaining leverage is always greatest before you begin a job – that’s when you have something to offer that the other party wants. Buffett learned this lesson the hard way as a kid, when his grandfather Earnest hired him and a friend to dig out the family grocery store after a blizzard. The boys spent five hours shoveling until they could barely straighten their frozen hands. Afterward, his grandfather gave the pair less that 90 cents to split.

- Watch Small Expenses: Buffett invests in business run by managers who obsess over the tiniest costs. He once acquired a company whose owner counted the sheets in rolls of 500-sheet toilet paper to see if he was being cheated (he was). He also admired a friend who painted only the side of his office building that faced the road.

- Limit What You Borrow: Buffett has never borrowed a significant amount – not to invest, not for a mortgage. He has gotten many heartrending letters from people who thought their borrowing was manageable but became overwhelmed by debt. His advice: Negotiate with creditors to pay what you can. Then, when you’re debt-free, work on saving some money that you can invest.

- Be Persistent: With tenacity and ingenuity, you can win against a more established competitor. Buffett acquired the Nebraska Furniture Mart in 1983 because he liked the way its founder, Rose Blumkin, did business. A Russian immigrant, she built the mart from a pawnshop into the largest furniture store in North America. Her strategy was to undersell the big shots, and she was a merciless negotiator.

- Know When to Quit: Once, when Buffett was a teen, he went to the racetrack. He bet on a race and lost. To recoup his funds, he bet on another race. He lost again, leaving him with close to nothing. He felt sick – he had squandered nearly a week’s earnings. Buffett never repeated that mistake.

- Assess the Risks: In 1995, the employer of Buffett’s son, Howie, was accused by the FBI of price-fixing. Buffett advised Howie to imagine the worst- and best-case scenarios if he stayed with the company. His son quickly realized the risks of staying far outweighed any potential gains, and he quit the next day.

- Know What Success Really Means: Despite his wealth, Buffett does not measure success by dollars. In 2006, he pledged to give away almost his entire fortune to charities, primarily the Bill and Melinda Gates Foundation. He’s adamant about not funding monuments to himself – no Warren Buffett buildings or halls. “When you get to my age, you’ll measure your success in life by how many of the people you want to have love you actually do love you. That’s the ultimate test of how you lived your life.”

Leave a Reply