Author: Tyler Virgin

-

Secrets of Xero Control Accounts – Partial Payments & Refunds

Objective: How to Credit Note an Invoice using Partial Payment for a Partial Refund resulting in Cancellation of Invoice in Xero.

-

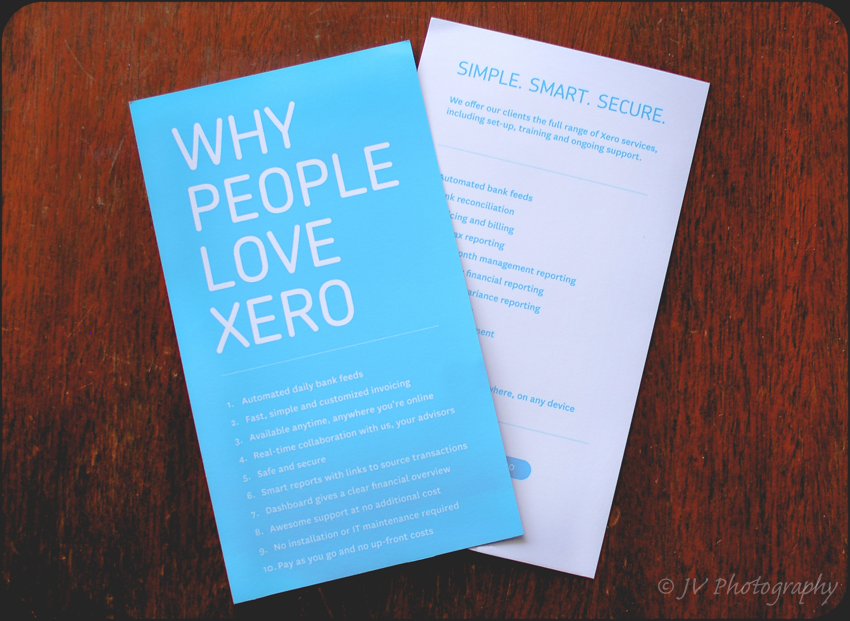

Why Xero?

WE ARE FANS OF XERO Xero Is A Cloud-Based Accounting Software For Your Virtual Business Needs.

-

How Business Structure Affects Taxes

One question that I often hear is what type of business organization should I choose and how business structure affects tax. While reading Accounting Today, which I am sure that all of you do, I saw this infographic (How Business Structure Affects Taxes) recently and thought it was a great reference for a small business…

-

Three Awesome Reasons to Choose the S Corporation

I don’t know about you guys but has anyone else searched the internet endlessly for how to choose to between an LLC, C Corporation, or an S Corporation? I know that I have typed in LLC vs. C Corporation vs. S Corporation many times into google or youtube but always come away conflicted. If you…

-

Inherited Annuity Tax Implications

Inherited an annuity and now trying to figure out the inherited annuity tax implications? First of all I am sorry for your loss as my family has just experienced this very scenario. The first thing to understand is the common feature of all annuities. A portion of the annuity income is considered a return…

-

Home Health Caregiver Hiring and Taxes

What if you loved one does not want to go to a nursing home? In order to stay at home and avoid a nursing home, the client may have to hire a Home Health Caregiver. When considering Home Health Caregiver Hiring and Taxes there are three options to take into account.

-

Standard Business Mileage Rate

The standard business mileage rate can result in one of the biggest deduction that a small business owner can realize. Usually, the standard mileage rate will create a larger deduction than the actual costs of operating a car. The problem is that we are all to lazy to keep the required mileage log. To help…

-

Gift Tax Annual Exclusion Demystified…..Maybe ?

Gift Tax Annual Exclusion The gift tax annual exclusion are one of the most misunderstood and complicated concepts of taxes. The most common confusion surrounds who pays the gift tax. With that said I want to define gift taxes from the donee (receiver) and the donor (giver) in order to further your understanding. The donee (receiver)…

-

Revenue vs Deferred Income – What does this mean to a small business owner?

There is sometimes confusion concerning financial statement terms for revenue vs deferred income. Ok, who am I kidding there is always confusion on revenue vs deferred income for small business owners. Depending on the business model chosen the terms can be essential in understanding how to recognize revenue. So the question is: what should a small…

-

Does a partnership or corporation have to file a tax return even though it had no income for the year?

Say you start a new partnership or corporation in October or November but don’t actually start business operations until the next calendar year. Or how about you have a business in a transition period where the is no income for the current year. Do you have to file a tax return even though it had no…