Category: Accounting

-

Secrets of Xero Control Accounts – Partial Payments & Refunds

Objective: How to Credit Note an Invoice using Partial Payment for a Partial Refund resulting in Cancellation of Invoice in Xero.

-

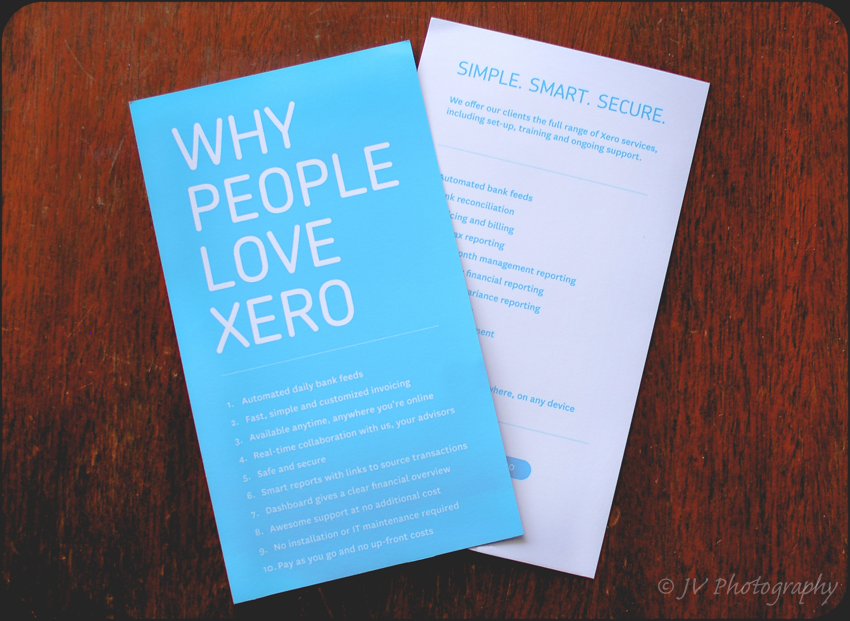

Why Xero?

WE ARE FANS OF XERO Xero Is A Cloud-Based Accounting Software For Your Virtual Business Needs.

-

How Business Structure Affects Taxes

One question that I often hear is what type of business organization should I choose and how business structure affects tax. While reading Accounting Today, which I am sure that all of you do, I saw this infographic (How Business Structure Affects Taxes) recently and thought it was a great reference for a small business…

-

Three Awesome Reasons to Choose the S Corporation

I don’t know about you guys but has anyone else searched the internet endlessly for how to choose to between an LLC, C Corporation, or an S Corporation? I know that I have typed in LLC vs. C Corporation vs. S Corporation many times into google or youtube but always come away conflicted. If you…

-

Standard Business Mileage Rate

The standard business mileage rate can result in one of the biggest deduction that a small business owner can realize. Usually, the standard mileage rate will create a larger deduction than the actual costs of operating a car. The problem is that we are all to lazy to keep the required mileage log. To help…

-

Revenue vs Deferred Income – What does this mean to a small business owner?

There is sometimes confusion concerning financial statement terms for revenue vs deferred income. Ok, who am I kidding there is always confusion on revenue vs deferred income for small business owners. Depending on the business model chosen the terms can be essential in understanding how to recognize revenue. So the question is: what should a small…

-

Markup vs Margin

Price setting is often a place of mass confusion for small business owners. I know for myself it is hard to find the price that optimizes profits while maintaining my competitive advantage. Understanding the difference between margin and markup on price increases is a must for properly achieving your profit goals.

-

How to Use Per Diem Rates for Small Business

Small business owners are always trying to make their lives easier and efficient. Who could blame them. This article aims to explore the entrepreneurs option to use per diem rates while traveling. Basically there are two ways one can deduct travel expenses. The actual cost of meals, incidental expenses, and lodging can be deducted provided…

-

Three types of profit measures that small business owners should be concerned?

There are many different measurements of profit that can cause confusion while presenting the financial statements. Our main goal here is to explain how to use the three types of profit and the differences between them in the most simple way possible. Three types of profit measures that small business owners should be concerned?

-

Balance Sheet Simplified and Defined

The Balance Sheet Simplified The balance sheet is a statement of financial condition on what a firm’s assets, liabilities, and stockholder’s equity are at a point in time with the essence of the total of all “assets must equal the sum of liabilities and stockholders’ equity.” (Fraser and Ormiston 37). The balance sheet is understood…